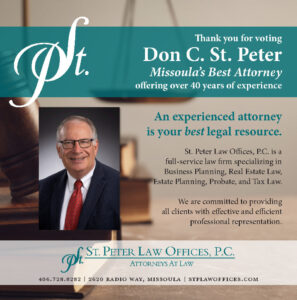

Recent Awards

Here are images of recent awards and press the firm is proud to have received.

An experienced attorney is your best legal resource.

St. Peter Law Offices , P.C. is committed to providing its clients with effective and efficient professional representation.

Over 30 years of experience in step-parent, private, interstate, international, agency, adult, and contested adoptions.

Learn More

Incorporation, LLC Organization, hiring practices, guarantees, corporate taxes, contracts, sales, manufacturing, etc.

Learn More

Creation and execution of wills for both testators and inheritors, establishment of Powers of Attorney, as well as trust creation and administration.

Learn More

Ensuring efficient and just probate of estates and administration of trusts, including cases of intestacy and contested wills.

Learn More

Montana real property law, including deeds, acquisition, estates in land, conveyancing, future use control, and nonpossessory interest.

Learn More

With experience in many fields of civil law, our legal team is prepared to help you succeed with your lawsuit.

Learn MoreRead more about the practice areas of St. Peter Law Offices

In July 1993, Don C. St. Peter and Linda C. St. Peter established their law practice with the intention of providing a smaller more personal, client-oriented law firm. St. Peter Law Offices, P.C., focuses on serving individuals, businesses, nonprofit corporations and families.

The law firm’s experience and services are broad:

The attorneys at St. Peter Law Offices, P.C. support Montana families through their law practice and participate in the growth and development of the business community.

We look forward to the opportunity to represent you in any of your legal matters.

Don is admitted to practice law before the Montana Supreme Court, the United States District Court for the District of Montana, and the United States Tax Court. His practice emphasizes tax matters including, offers and compromise, employee benefits, estate planning, low-income housing tax credit projects, HUD and Rural Development Loans and Bonds proceeds, and corporate and commercial transactions.

Mike is admitted to practice law before the Montana Supreme Court, the United States District Court for the District of Montana and the United States 9th Circuit Court of Appeals. Mike is also licensed to practice law in Washington, Wyoming, Colorado, Idaho and the Confederated Salish and Kootenai Tribal Court. His practice emphasizes litigation in the areas of personal injury, commercial, real estate, probate and construction suits.

Logan is admitted to practice law before the Montana Supreme Court and the United States District Court for the District of Montana. Logan is also licensed to practice law in Washington, Wyoming and the Confederated Salish and Kootenai Tribal Court. Logan’s practice focuses on litigation in the areas of probate, commercial, real estate and adoptions.

Makayzia is admitted to practice law before the Montana Supreme Court and the United State District of Montana. Makayzia is also licensed to practice law in Wyoming, Washington and the Confederated Salish and Kootenai Tribal Court. Makayzia’s practice focuses on business and corporate law, estate planning, probate, guardianship, conservatorship, powers of attorney and trusts.

Here are images of recent awards and press the firm is proud to have received.

St. Peter Law Offices, P.C., is pleased to announce that Logan Nutzman has joined the firm as an associate attorney. Logan...

THE PROBATE PROCESS FROM START TO FINISH March 27, 2019 — DoubleTree by Hilton Hotel Missoula 100 Madison Street, Missoula,...